Flexible plastic packaging is a versatile, durable solution produced using lightweight, flexible plastic materials. It is widely used multiple Industries, including food & beverage, pharmaceuticals, personal care, and household products.

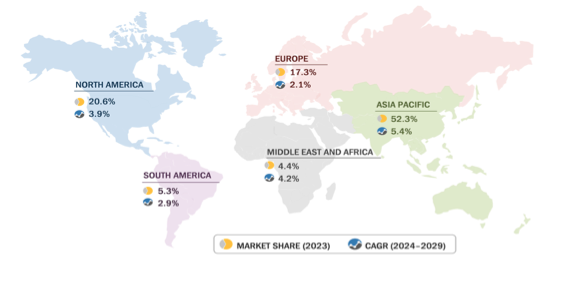

This type of packaging protects products from external elements such as light, air, and contaminants, which can degrade their quality. Additionally, flexible plastic packaging stands out for cost effectiveness, as it requires less material than rigid packaging alternatives, making it a more affordable option for manufacturers. According to the Industry Council for Research and packaging on the Environment (INCPEN), this packaging helps reduce food wastage and increase the shelf life of food products. According to MarketsandMarkets the flexible plastic packaging market was valued at USD 199,238.3 million in 2023 and is projected to reach USD 257,580.0 million by 2029. The Asia pacific market expected to register the highest CAGR of 5.4% during the forecast period in terms of value. The market growth can be attributed to the growing of convenience the booming e-commerce Industry, rapid urbanization, and increased disposable income. Changing consumer lifestyles are significantly impacting the flexible plastic packaging market, driven by the growing preference for convenience, sustainability, and easy access to products. The growing demand for on-the-go, ready-to-eat, and single-serve 'terns has Increased the need for lightweight, portable packaging. Additionally, the rise of ecommerce has amplified the demand for protective, space efficient packaging as the global population is expected to reach 8.6 billion 2030 and 9.8 billion by 2050, with further growth projected to 11.2 billion by 2100, the demand for food is set to rise significantly, driving the need for more efficient and sustainable packaging solutions. Flexible plastic packaging meets this demand by offering cost-effectiveness, reduced weight, and the ability to hold more products with less material than rigid alternatives leading to lower production costs and better storage efficiency. Innovations In flexible plastic packaging such as embedded sensors, oxygen scavengers, and high-barrier films, are enhancing product freshness and safety. Smart packaging features such as QR codes, NFC tags and sensors enable consumers to access information, track freshness, and tampering These advancements improve both functionality and consumer experience, driving the growth of the flexible plastic packaging market.

Bags are projected to be the fastest-growing packaging type in the flexible plastic packaging market due to their convenience, versatility, and cost effectiveness. They offer lightwe.t, space-saving solutions that are ideal for a wide range of products, from food and beverages to consumer goods. The ability to customize bas in various sizes, shapes, and features, such as resealable closures or spouts, attracts both manufacturers and consumers. Bags also provide excellent protection, preserve freshness, and are more than rigid packaging, as they require less material. Bags, particularly multi-layered flexible films, offer excellent barrier properties against and light, which helps extend product shelf life, particularly for food and pharmaceutical items. With increasing consumer demand for convenience and eco-friendly options, have become the preferred choice in the flexible plastic packaging segment. The rising demand for sustainable packaging solutions has fueled the growth of ecofriendly bags such as those made from recyclable or biodegradable materials, aligning with consumer preferences for environmentally responsible packaging options.

South America

The flexible plastic packaging market in South America has been segmented into Brazil, Argentina, and the Rest of South America, which includes Chile, Colombia, Venezuela, and Peru. According to the World Bank Group, South America is projected to experience a GDP growth rate of 1.6% In 2024, marking It as the lowest among all global regions. However, the forecast for 2025 indicates a slight improvement, with the region expected to grow by 2.6%. The South American food and beverage (F&B) sector is expanding, driven by increasing urbanization, a rising middle class, and changing consumer habits. As urban populations and more consumers lead busy, fast-paced lifestyle, the demand for convenient, on-the-go food and beverage products Is rising. Flexible packaging, which is lightweight, portable, and versatile, is ideal for products like snack pre-packaged meals, drinks, and single-serve portions. The rise of e-commerce South America has further accelerated the need for efficient, cost-effective packaging solutions that can withstand the demands of shipping and handling Flexible plastic packaging is ideal for ecommerce due to its adaptability and the ability to reduce shipping as It takes up less space and is lighter than traditional packaging As online food and beverage sales continue to grow, flexible plastic packaging will play a pivotal role in meeting the needs of consumers and retailers. However, this region has the potential for flexible plastic packaging market growth as countries such as Brazil and Argentina 2021 plan to increase beef exports to other countries. The region is a promising market for flexible plastic packaging due to economic growth and increased environmental concerns. As economies continue to develop, demand for packaged goods has grown, increasing the use of flexible plastic packaging. In urban South America, growing consumer awareness of environmental issues is driving demand for flexible plastic packaging made from recyclable, biodegradable, or postconsumer recycled materials. In response, manufacturers are investing in sustainable packaging technologies, which is fueling growth.

ECONOMIC GROWTH TO FUEL DEMAND

Brazil is the largest and most developed country in South America. According to the International Monetary Fund (IMF), its GDP was USD 2.12 trillion In 2023. According to the United Nations Statistics Division, Brazil has the largest geographical area in South America. One of the key global food producers and exporters, Brazil offers significant opportunities for suppliers in the food processing industry. In 2023, the Brazilian food processing sector registered revenues of USD 231 billion, reflecting a 7.2% increase compared to the previous year, according to the Brazilian Food processors Association (ABIA). This growth represents 10.8% of the national GDP and underscores Brazil's significant role as a global food producer and exporter. The Major categories of food processing Include meats, dairy, cereals, tea, Coffee, oils and fats, sugar, snacks, ice cream, condiments, yeast wheat products, processed fruits and vegetables, dehydrated and frozen products, chocolate, candy, and fish. This expansion in the food processing industry directly impacts the flexible plastic packaging market. As food manufacturers seek to preserve product quality, extend shelf life, and enhance convenience, flexible plastic packaging becomes increasingly vital.

Brazil is the largest healthcare In Latin America and spends 9.47% of Its GDP on healthcare, which represents USD 161 billion. As the country’s healthcare system develops, regulatory agencies such as ANVISA (Agéncia Nacional de Vigiläncia Sanitaria) in Brazil are increasingly emphasizing product safety and traceability. This has led to increased investments in infrastructure and services, creating a need for Innovative packaging options such flexible plastic packaging.

www.marketsandmarkets.com